Until all conditional requirements are met by Bank Negara, MyMy remains reserved about disclosing their full product proposition. But while acknowledging the large number of wallets already in the market, MyMy claimed that it isn’t just another e-wallet player. “Our plans to become the world’s first Shariah-compliant digital bank is still within our sights and will take its form with the right conditions set by our committee and our consortium partners,” said MyMy chairman Tunku Ahmad Burhannudin.

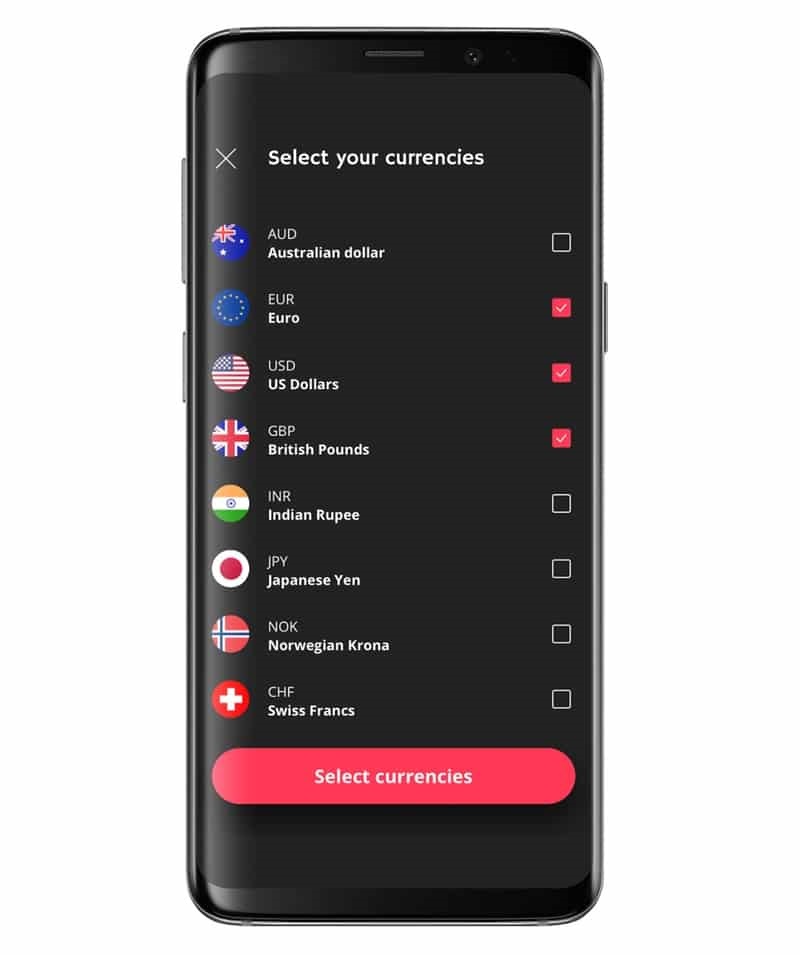

MyMy said it signed Malaysia’s biggest seed fundraising round from Koperasi Tentera in September 2020. It also inked a partnership with Sukaniaga to form Malaysia’s first digital banking consortium last month. On its official website, MyMy claims to offer “Malaysia’s first real multi-currency account and card”, which allows users to instantly change their ringgit into 11 different currencies (with more to come, apparently) with no hidden fees and real-time exchange rates. Those interested can pre-register for access to MyMy’s beta programme by clicking here, but access will only be granted when Bank Negara has sufficed all of the conditional requirements and given final approval. (Source: MyMy. Images: MyMy [1] [2].)